Conveniently save with CollegeBound Saver

Easy to get started

Open an account in 10 minutes. It is surprisingly easy to sign up. And once you do, you’re done!

Save on autopilot

Set up recurring contributions from your bank account or use our payroll deduction feature to contribute right from your paycheck.

A schedule that works for you

Whether you are an early riser or a night owl, you can easily manage and update your account online anytime.

Manage your money the easy way

Your savings is never more than a click away. Contribute anytime, plus quickly and securely make withdrawals.

Get StartedMonitor and adjust your contributions

Your CollegeBound Saver account is designed to help you reach your savings goals. With the touch of a button, our free tools can make it even easier to save more.

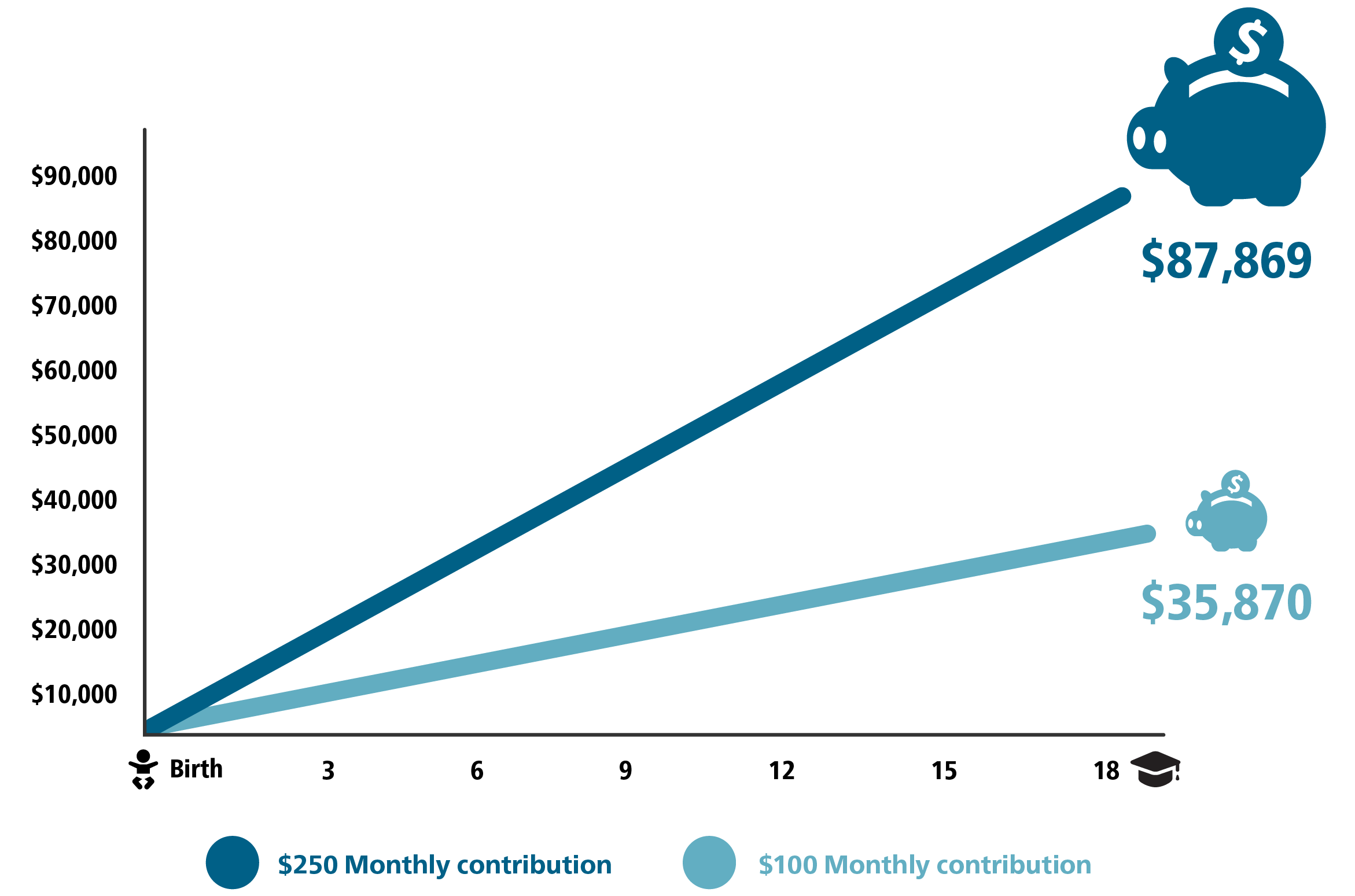

Your savings can add up

Small, consistent contributions can make a big difference in meeting your goals.

Get Started

* Assumptions: $500 initial investment with subsequent monthly investments of $100 or $250 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution.

1An investment plan of regular investment cannot assure a profit or protect against a loss in a declining market.

2Earnings on non-qualified distributions may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. Tax and other benefits are contingent on meeting other requirements and certain distributions are subject to federal, state, and local taxes.